News Release from Bureau of Land Management Ore. & Wash.

May 15th, 2019 9:26 AM

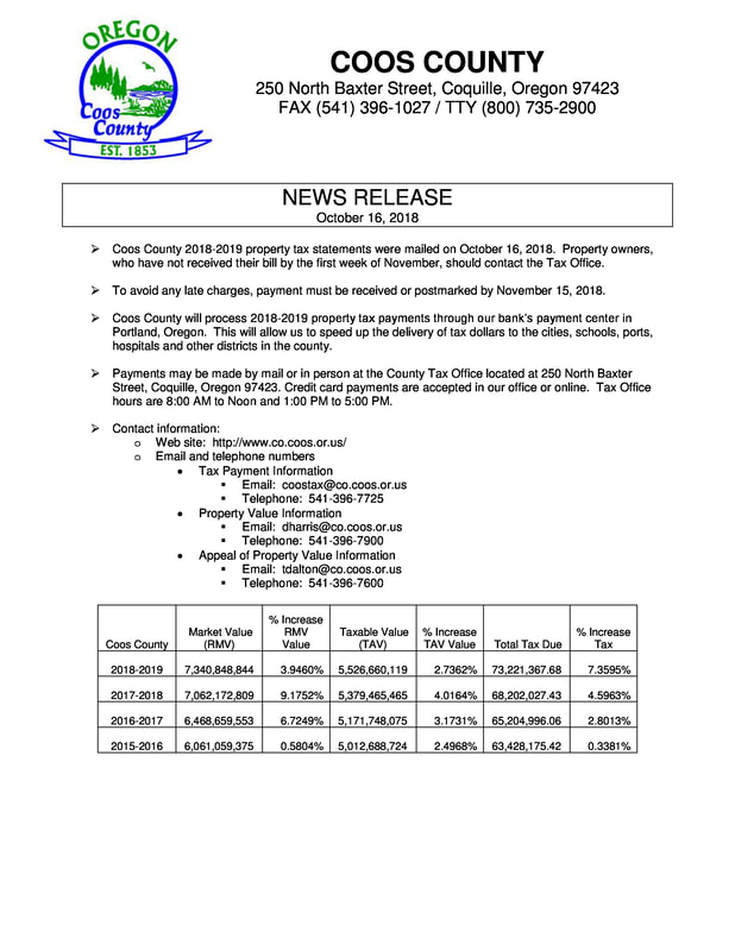

WASHINGTON – U .S. Secretary of the Interior David Bernhardt announced today the issuance of $30.1 million to 18 counties in western Oregon as a part of the Secure Rural Schools (SRS) and Community Self-Determination Act extension. The funding will go directly to the counties, supporting investments in education, infrastructure, public safety, health services, and other critical expenditures made by these jurisdictions.

“The money appropriated to these communities through the Secure Rural Schools Act is critical to their continued prosperity and the vibrancy of our public lands,” said Secretary Bernhardt. “At the Department of the Interior, we are committed to being a good federal partner and neighbor, and this program is one way we help these local economies.”

“This announcement is welcome news for Oregon counties that rely on this program,” said U.S. Rep. Greg Walden (OR-02). “I worked closely with the last two Republican Speakers of the House to secure SRS funding for our schools and counties. I applaud the Trump Administration for prioritizing rural Oregon and promptly issuing these payments. While we are all pleased the checks are getting written, what we really need is reform of forest management so we can reduce the size and severity of wildfires and produce good paying jobs and tax revenues in our forest counties. I look forward to continuing to work with President Trump and his team to achieve that goal.”

Background

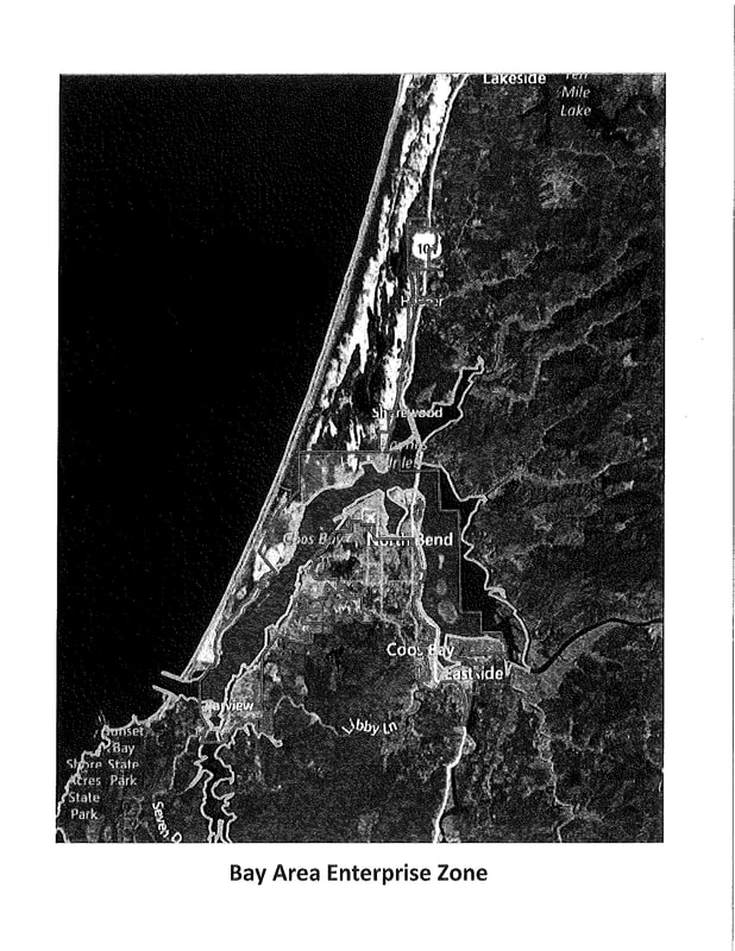

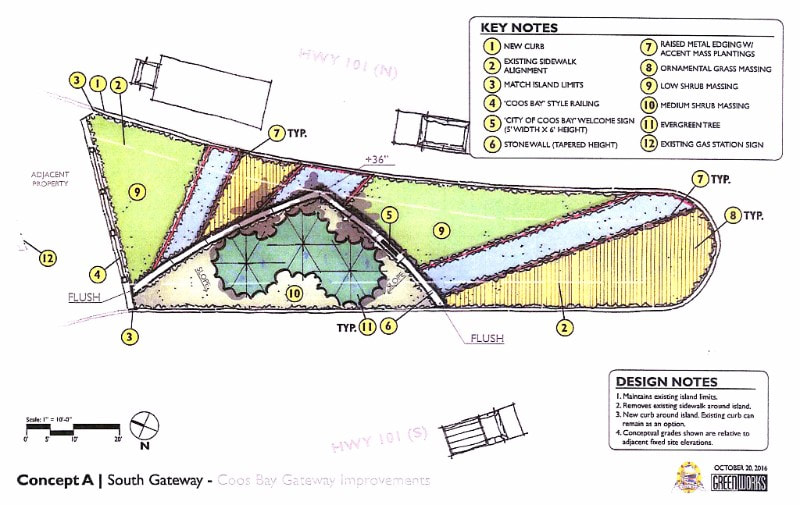

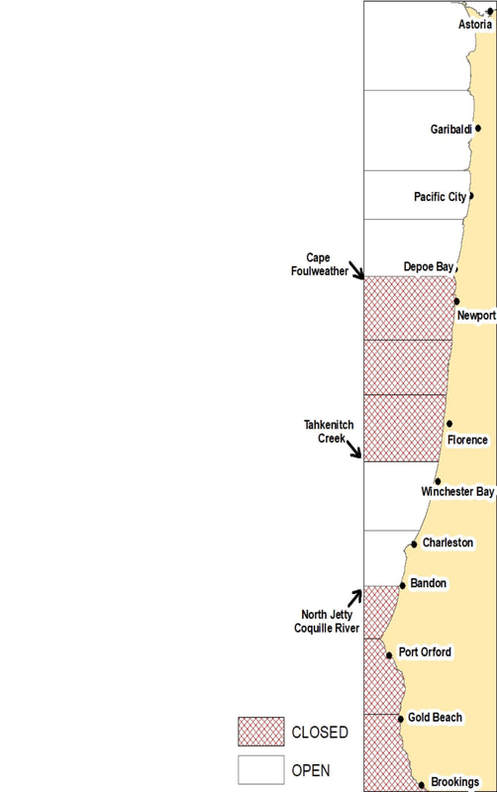

The Bureau of Land Management (BLM) manages the SRS program in Oregon and California Railroad Revested Lands, known as the O&C Lands, in concert with the U.S. Forest Service. The O&C Lands lie in a checkerboard pattern through 18 counties of western Oregon. These lands contain more than 2.4 million acres of forests with a diversity of plant and animal species, recreation areas, mining claims, grazing lands, cultural and historical resources, scenic areas, wild and scenic rivers, and wilderness. SRS payments are made to over 700 counties across the United States, including the 18 counties containing O&C Lands, according to a formula set by Congress.

The O&C Lands Act and Coos Bay Wagon Road (CBWR) Act require 50 percent of receipts collected from the sale of timber on O&C lands to be distributed among 18 counties in western Oregon. The payments follow a formula established by these laws, both of which authorize timber receipt-based payments to western Oregon counties, and both of which remain in effect following the expiration of the SRS and Community Self-Determination Act.

Contact Info, for media use only:

[email protected]

RSS Feed

RSS Feed