Commissioners Cribbins & Sweet are going to delete the expiration date from the current plan, allowing the debt to exist in perpetuity. The agency has the capability of a maximum indebtedness of Sixty Million Dollars. They are going to enact the extension by just a vote of the Board of Commissioners thus eliminating the voice of the voters.

Imposing a time limit on the UR debt meant it had an ending date, but no expiration means the politicians never have to pay off this $60 million dollar Charge Card.

The alternatives for the county Board of Commissioners is to pay off the current UR debt of $50,000, shut down the agency, and allow those property taxes to flow into the districts that were supposed to get the money in the first place.

The county's Urban Renewal Agency formed the North Bay Urban Renewal District back in 1986, and they updated the plan for that district three times since, once in 1998, then again in 2000, and again in 2006. The most recent plan allows the district to sunset in 2018.

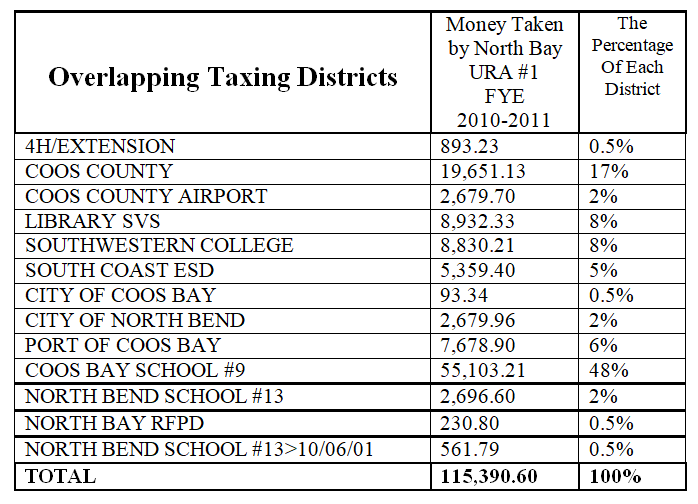

The UR agency pays the district's debt through a process called Tax Increment Financing. TIF is a taxing scheme designed to siphon money from other taxing districts that overlap the urban renewal area. Those include the Coos Bay Fire District, the cities of North Bend and Coos Bay, and the Coos Bay & North Bend School District. Also, there are several countywide districts including the airport district, the county, the library district, and SWOCC, so every property owner in the county contributes to the North Bay URA.

When a city or a county wants to obtain TIF funding, they create a boundary around an underdeveloped, blighted area of their choosing and that is the urban renewal taxing district. The revenue generated from the property taxes remains in a frozen state from that point on, and that becomes the base taxes, which will continue to fund the other overlapping taxing districts. However, after that day, the UR agency retains all the increase over the frozen tax base, which is the tax increment.

The districts that are losing money due to TIF eventually have to replace that loss by either raising fees and new taxes or cutting essential services to the public, which is the usual practice. These budget cuts have had damaging effects on the community, especially when it comes to public safety.

The taxes collected through the UR district is nondiscretionary funding. The members of the URA board can spend it on any political pet project they deem necessary, which concentrates too much money and power into the hands of the political elite. Many of these projects are nothing more than welfare for private corporations paid for with public dollars.

The worst aspect of the agency is the ability to use its authority to make "eminent domain" claims against any private property inside the UR area. Private ownership is the cornerstone of a free society. Allowing bureaucrats the power to seize assets undermines those values and destabilizes the market.

The original purpose of urban renewal was to eliminate blighted areas by removing abandoned buildings, deteriorated houses or debris left from past industrial projects, but the government has expanded the definition of blight. Now, in some cases, the money goes directly to developers to pay for construction costs and building improvements. Some UR money has gone to cover mortgages and even to pay for advertising for private business.

There is no proof that Urban Renewal will generate new jobs or increase the tax base. In fact, most studies have found no evidence that municipalities with Urban Renewal Agencies developed any faster than ones without it did. In one thorough study from September of 1999 titled "The Effects of Tax Increment Financing on Economic Development" it stated, In summary, the empirical evidence suggests that TIF adoption has a real cost for municipal growth rates. Municipalities that elect to adopt TIF stimulate the growth of blighted areas at the expense of the larger town. We doubt that most municipal decision-makers are aware of this tradeoff or that they would willingly sacrifice significant municipal growth to create TIF districts. Our results present an opportunity to ponder the issue of whether, and how much, overall municipal growth should be sacrificed to encourage the development of blighted areas.

The people of Coos County are weary of the shenanigans of our local politicians and the special interest groups in which they serve. Demand that Commissioners Cribbins and Sweet honor the will of the people, or suffer the consequences in the next election. Saving money is simple as conveying the message, so show up at 1:30 pm to the Public Hearing on August 31, 2017, and the Final Vote on September 12, 2017, in the Owen Building, Coquille Oregon.

About the author:

Rob Taylor is the founder of a virtual network of activists at CoosCountyWatchdog.com and the chief petitioner for the Second Amendment Preservation Ordinance.

RSS Feed

RSS Feed