Visit The Facebook page:

www.facebook.com/ShutDowntheCoosCountyURA

Shut Down the Coos County URA

Please LIKE, FOLLOW and then SHARE our page to let your friends know about our effort to end a useless tax that everyone in the county contributes too.

Please press the Volunteer Button if you would like to volunteer for the campaign

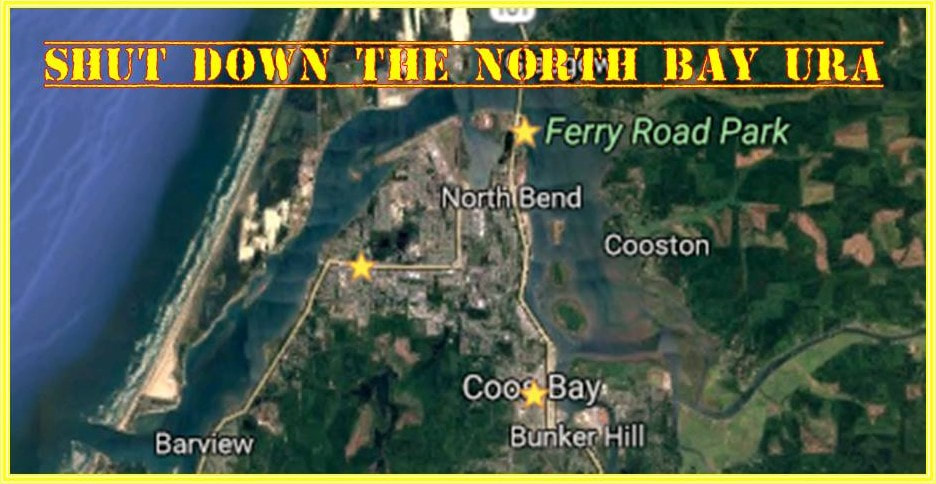

History of the North Bay URA

The UR agency may pay the district's debt with federal or state grants. In this case, the agency pays the debt through a process called Tax Increment Financing. TIF is a taxing scheme designed by the Oregon Legislature to siphon money from other taxing districts that overlap the urban renewal area. The taxing districts that the North Spit URA overlap include The Coos Bay School District, the North Bay Rural Fire District and except for 16.3 acres of NB estuary land and 163.39 acres of CB estuary land most of North Bend and Coos Bay lands are predominantly beneath the water in the Coos Bay channel. There are several countywide districts including the airport district, the county, the library district, and SWOCC, so every property owner in the county contributes to the North Bay URA.

Coos County-wide, property taxpayers contribute approximately $0.0368 per $1,000 assessed value toward the Coos County Urban Renewal Agency, and $0.0229 toward the CCURA Special Levy, which is six cents per every $1,000 of AV. A $200,000 home would be charged $12.00 annually. The median-valued home is about $140,000, which would pay $8.40. The current debt of the North Bay URA is approximate $50,000.

Unfortunately, that amount can and most likely will change depending on the projects the URA Board decide to undertake. The new UR plan has $3 to 18-million dollars of expenditures listed as new projects, and it has the capability of going into a maximum indebtedness of 60-million dollars.

Oregon property taxes going to these Urban Renewal Agencies through the TIF process in FY 2009-2010 was $182-million. According to data collected from the “OR Property Tax Annual Statistics FY 2016-2017” found on the Oregon Department of Revenue’s website, there are 110 Urban Renewal Agencies statewide in FYE 2016-2017. These UR agencies received $223.3-million from the “Revenue from Excess,” while others received an additional $21.1-million from special levies totaling $244.4-million diverted from other various taxing districts. “Revenue from Excess,” is the property tax revenue generated by increased property values inside the UR area over the frozen increment when the authorities enacted the plan for the district.

In FY 2017, Public education alone lost $87.2-million in potential revenue because of urban renewal activity. Cities lost $73.3-million in that same fiscal year, and counties lost $41.5-million, which includes the $28.2-million taken by Multnomah County. Other districts, including Fire Districts, lost $21.3-million.

The idea of redevelopment is to increase the property values of the urban renewal area as a way to bolster the local tax base---all to generate new business that most likely would have taken place with or without these public incentives.

Time to End the Debt and Shut Down the North Bay URA

In other words, the lawyers working for the local politicians found a loophole in the state ORS to get out of facing the people in a showdown at the ballot box.

However, “The Committee to Shut-Down the CCURA” has another plan. The group is going to file a referendum to put the amendment on the ballot after the commissioners enact it.

The following points are a few reasons to oppose Tax Increment Financing funding and to end all Urban Renewal Agencies.

The criteria for using Urban Renewal money has become so vague that some would consider it a discretionary slush fund for politicians to choose how to spend.

Politicians use Urban Renewal to centralize power and money into the hands of the few politically connected.

Politicians created Urban Renewal as an artificial construct designed to manipulate and compensate certain segments of the market.

Politicians funnel public money through Urban Renewal to corporations for private profit.

Politicians use Urban Renewal incentives to develop pristine natural areas that normally would remain as undeveloped wilds.

Politicians can use Urban Renewal to make eminent domain claims against private property inside the taxing area, which erodes the right of ownership.

Politicians use Urban Renewal funding as seed money to create new taxing districts that maintain unnecessary projects at the expense of necessary services. Those projects include auditoriums, carousels, convention centers, swimming pools, sports stadiums, and theaters, which take money from colleges, hospitals, libraries, schools, police and fire departments.

Some independent studies have found little evidence that municipalities with Urban Renewal Agencies developed any faster than ones without it did. In one thorough study written in September of 1999 by two professors of economics, Richard F. Dye and David F. Merriman, titled "The Effects of Tax Increment Financing on Economic Development" it stated, “In summary, the empirical evidence suggests that TIF adoption has a real cost for municipal growth rates. Municipalities that elect to adopt TIF stimulate the growth of blighted areas at the expense of the larger town. We doubt that most municipal decision-makers are aware of this tradeoff or that they would willingly sacrifice significant municipal growth to create TIF districts. Our results present an opportunity to ponder the issue of whether, and how much, overall municipal growth should be sacrificed to encourage the development of blighted areas.”

A Senior Fellow at the CATO Institute made the case against Urban Renewal and Tax Increment Finance in a paper titled, “The Case against Tax-Increment Financing” by Randal O’Toole. In it, he stated, “There are two problems with any attempts to reform TIF. First, no matter how much legislatures may try to focus TIF on genuine examples of blighted neighborhoods, cities will find ways to get around such safeguards. Second, there is little evidence that city governments are better than private developers at determining the type and location of new development that cities need, and plenty of evidence that they are not as good. Instead of reforming TIF, state legislatures should simply repeal the laws that give cities and counties the authority to use it and similar tools to subsidize economic development.”

| | |

RSS Feed

RSS Feed